New “Mansion Tax” - Santa Monica Measure GS and LA City Measure ULA

Los Angeles City’s Measure ULA and Santa Monica’s Measure GS are effective as of March 1, 2023 and April 1, 2023 respectively. In this post we will take a brief look at both measures and how they affect luxury property sales in the area.

Santa Monica Measure GS

Going into effect on March 1, 2023, Measure GS adds a third tier tax rate on the sale of properties over 8 million dollars within the City of Santa Monica. The funds raised by this measure will go towards schools, homelessness prevention, and affordable housing.

Prior to March 1, 2023 - Only two tax tiers in Santa Monica

Tier 1 - $3.00 (per $1,000) on sale amounts of $4,999,999 or less

Tier 2 - $6.00 (per $1,000) on sale amounts of $5,000,000 and above

Subsequent to March 1, 2023 - Santa Monica now has three tax tiers in the city

Tier 1 - $3.00 (per $1,000) on sale amounts of $4,999,999 or less

Tier 2 - $6.00 (per $1,000) on sale amounts of $5,000,000 to $7,999,999

Tier 3 - $56.00 (per $1,000) on sale amounts of $8,000,000 and above

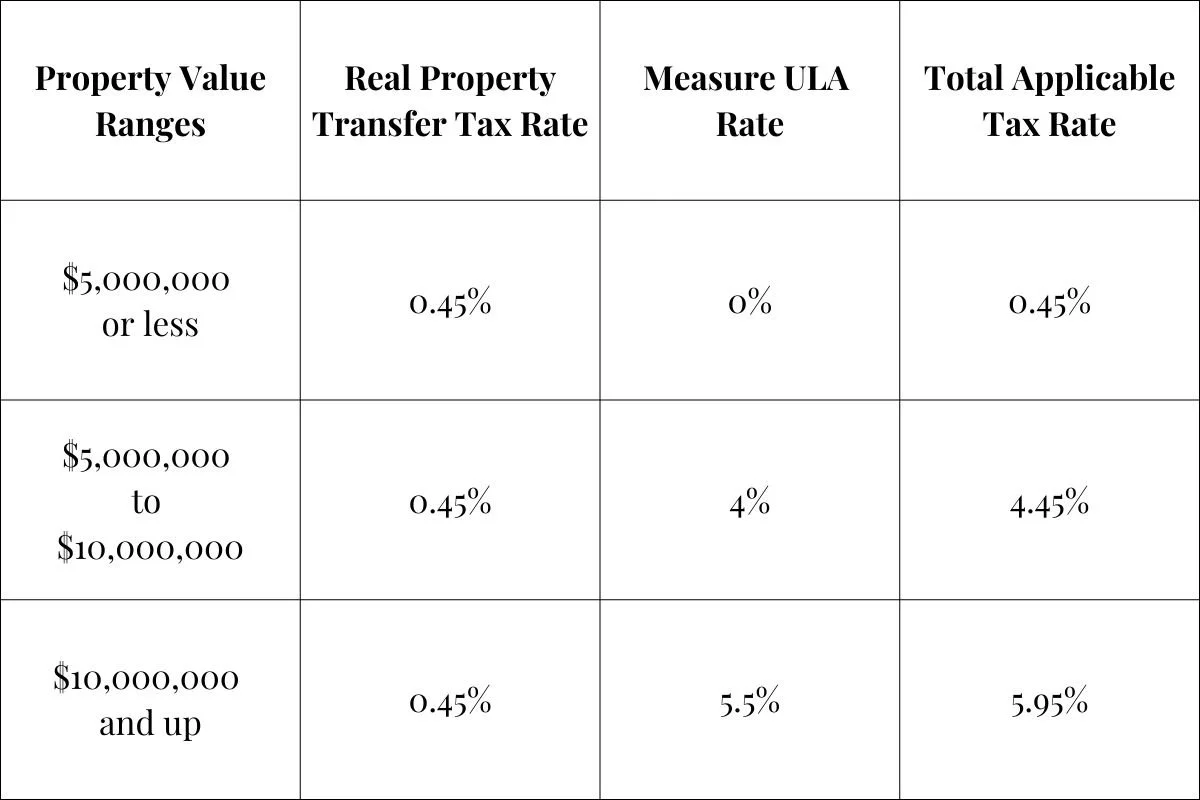

Los Angeles City Measure ULA

Going into effect on April 1, 2023, Measure ULA adds an additional transfer tax on the sale of properties in the City of Los Angeles, on top of the already existing transfer tax rate of 0.45% for sales over 5 million dollars and 10 million dollars. The funds raised by this measure will go towards increasing affordable housing and providing resources to tenants at risk of homelessness.

Prior to April 1, 2023

Property sold in the City of LA are charged a Real Property Transfer Tax of 0.45%

Subsequent to April 1, 2023

- Property Transfer Tax rate of 0.45% charged to the sale of properties $5,000,000 or less

- Property Transfer Tax rate of 4.45% charged to the sale of properties $5,000,000 to $9,999,999

- Property Transfer Tax rate of 5.95% charged to the sale of properties $$10,000,000 and up